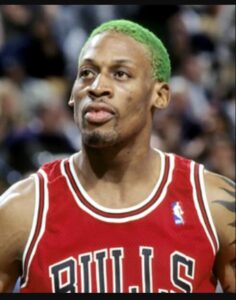

Former NBA All-Star Dennis Rodman is well known for his ferocious defense and rebounding skill as well as his tatoos, piercings and wild partying lifestyle. In the Personal Injury and Taxation legal community, Rodman is also famous for causing an incident that led to a landmark Tax case, Amos v. Commissioner, which created new law allowing the IRS to tax Personal Injury settlements which include Confidentiality provisions.

The Rodman Incident

On January 15,1997, Dennis Rodman was still in his prime as a defensive specialist with the World Champion Chicago Bulls and the Bulls were playing the Minnesota Timberwolves. After scrambling for a loose ball, Rodman fell into a group of photographers on the sideline. As the cameras rolled, while getting up, Rodman kicked cameraman Eugene Amos in the groin.

Amos sought medical treatment, filed a Police Report and retained a Personal Injury Lawyer to sue Rodman. Before a lawsuit was filed, Rodman’s lawyers negotiated a $200,000 settlement with Amos which included a Confidentiality provision requiring Amos to keep the incident and settlement secret.

The Tax Court Case

Relying on well-settled tax law that Personal Injury settlements are not taxable as income, Amos did not claim the $200,00 Rodman settlement on is income taxes. To his surprise, the IRS argued that he should have claimed the money as income because the settlement was really paid for Confidentiality rather than for Personal Injury.

The result of the Tax Court case was that the $200,000 settlement had to be fairly allocated between the amount paid for the Personal injury, which would be exempt from taxes, and the amount paid for Confidentiality, which was deemed taxable. For Amos, the Court decided that the split should be $120,000 for Personal Injury and $80,000 for Confidentiality.

Practical Tips for Dealing with Confidentiality Provisions in Personal Injury Cases

Given the Rodman incident and Amos Tax Court case, Personal Injury lawyers need to carefully advise clients about the potential tax consequences of agreeing to Confidentiality provivsions in Personal Injury Settlements. Here are two simple tips:

1- Don’t agree to Confidentiality unless you have to. If there is no Confidentiality provision, Personal Injury settlements or verdicts are not taxable.

2- Allocate and specify. If you have to agree to Confidentiality, make sure that the settlement agreement allocates money between the two claims and pay taxes on the amount allocated to Confidentiality. Also beware that the IRS may challenge the allocation and seek more taxes if the allocation is unfair.

Tim Rayne is a Car Accident and Personal Injury Lawyer with the Chester County law firm MacElree Harvey. For over 20 years, Tim has been helping injured accident victiims receieve fair treatment from insurance companies through settling and trying Personal Injury cases. Tim has offices in Kennett Square and West Chester, Pennsylvania. For a Free Personal Injury Case Evaluation, contact Tim Rayne at 610 840 0124 or trayne@macelree.com or check out his website at www.timraynelaw.com.