As a Car Accident Lawyer I see lots of Car Insurance Policies and, unfortunately, many of those policies have bad coverage.

Believe it or not, the choices that you make on your Car Insurance impact your legal rights and the rights of family members who live with you if you cause a car accident or are injured in a car crash caused by someone else.

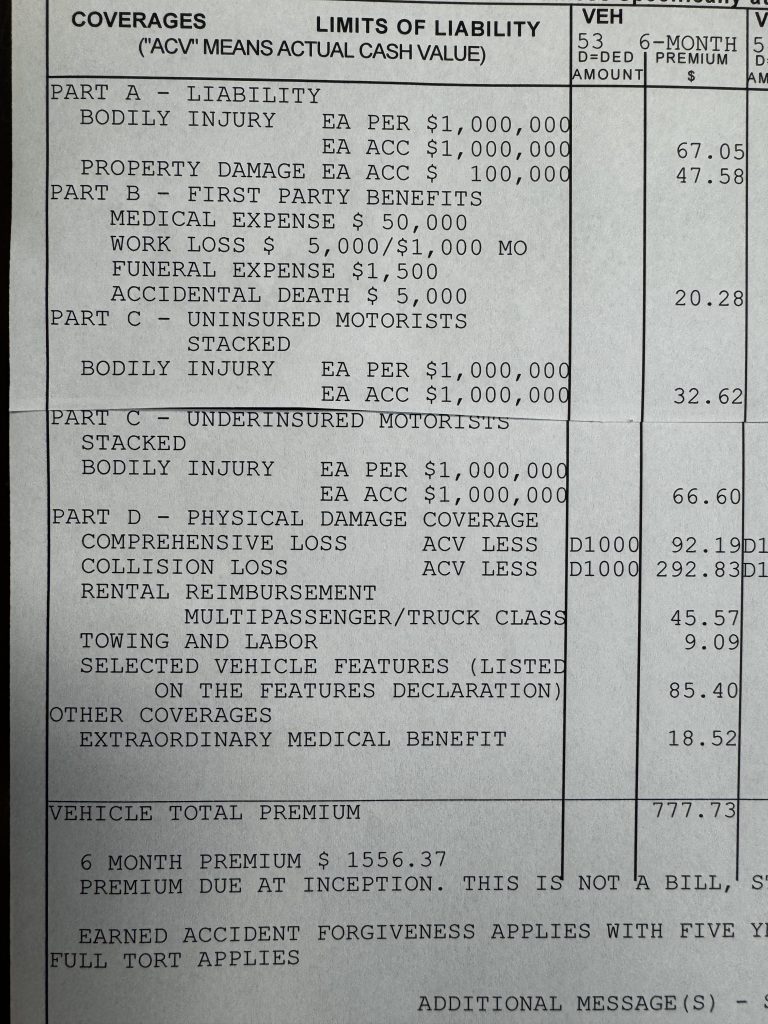

Last week, I ran across the Best PA Car Insurance Coverage that I’ve ever seen. Here it is and below is my explanation of why it is the best I’ve ever seen.

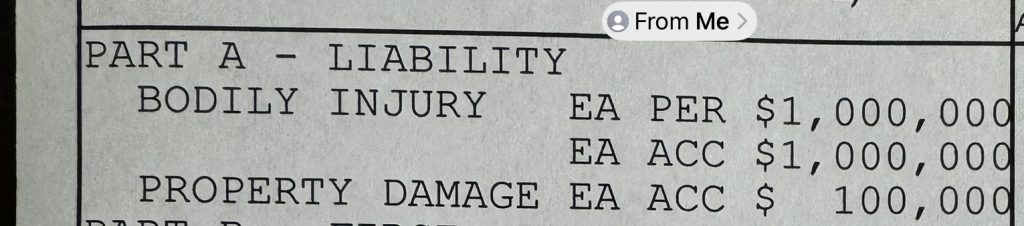

Liability Coverage

Liability Coverage provides protection to you and other drivers of your car who make a mistake and cause a crash that hurts someone or damages property.

The minimum liability coverage in Pennsylvania is $15,000 per person and $30,000 per accident for Bodily Injury and $5,000 for Property Damage. This Policy has much more, $1 Million for Bodily Injury and $100,000 for Property Damage.

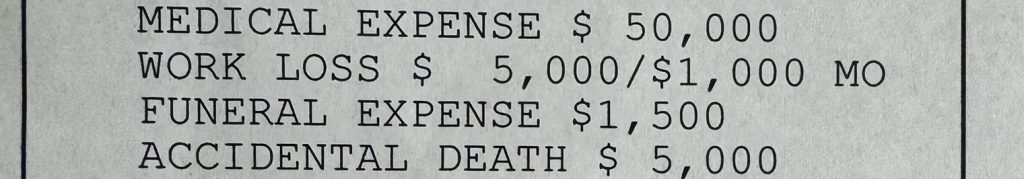

Increased First Party Coverage

Your Pennsylvania Car Insurance also has Medical Coverage that will pay for your medical bills regardless of who causes an accident. The PA state minimum and most common amount of No Fault Medical Benefits is $5,000. You can also purchase coverage for Lost Income, Funeral Expenses and Accidental Death which is optional, but useful coverage.

My client’s First Party coverage is excellent because he has $50,000 of Medical Coverage and he has purchased optional coverage for Work Loss, Funeral Expense and Accidental Death.

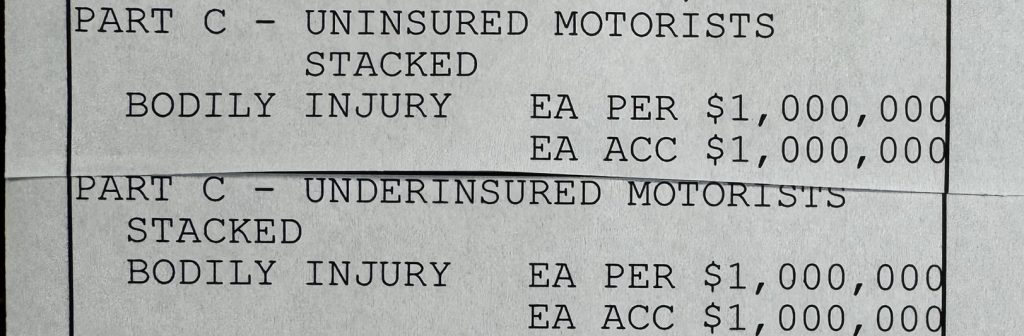

High Uninsured and Underinsured Coverage

Uninsured and Underinsured Coverage protects you, your family members who live with you and people who drive or ride in your car from injuries or death caused by Uninsured or Underinsured drivers. If a driver with no or low Car Insurance causes an injury or death to someone covered by your car insurance, then you or they can make a claim on your Uninsured or Underinsured Coverage to be fully compensated for all injuries and damages. In addition, the claim will not increase your insurance rates.

Because the minimum Bodily Injury Liability Coverage in PA is $15,000 per person/$30,000 per accident, it is critical for you to protect yourself and your family with ample Uninsured and Underinsured coverage.

This client has $1 million of Uninsured/Underinsured Coverage and he has “stacked” the Coverage which multiplies it by the number of vehicles on the Policy. Since he has two vehicles, he actually has $2 million.

Full Tort Not Limited Tort

This client also chose Full Tort, not Limited Tort on his Pennsylvania Car Insurance.

Full Tort protects his full legal rights to compensation after a Car Accident, while Limited Tort limits legal rights to compensation. With Limited Tort, an injured person cannot recover compensation for non-economic damages like Pain and Suffering absent a Serious Injury which is Death, Serious and Permanent Disfigurement or a Serious Impairment of Body Function.

Full Tort is preferable because your full legal rights are preserved.

Check Out Your Policy

Does your Car Insurance measure up or have you made critical errors in your Car Insurance choices? Pull out your Policy and see. Do you have Full Tort? How much Uninsured and Underinsured Coverage do you have? What are your Liability Limits? Is your family protected????

If you would like a Free Review of your Car Insurance Coverage feel free to call or email me at 610-840-0124 or trayne@macelree.com or check out my Free Book Protecting Your Family From Accidents on my website www.TimRayneLaw.com